🚀 The Book in 3 Sentences

- Aim to have roughly $0 left in your bank account when you die – otherwise you’ve saved too much.

- Money is a resource that helps you live your best life – not an end in itself.

- Invest in experiences when you’re young, to get compounding returns on your memories.

🎨 Impressions

Die With Zero is a practical guide for getting the most out of your money, and your short time on earth. It helped me realise that money is only as valuable as the life experiences you buy with it. Spend your life obsessing about your bank balance, and you’ve missed the point.

🧭 How I Discovered It

The book came out mid-2020. I think I came across it in my friend Khe Hy’s newsletter Rad Reads.

👤 Who Should Read It?

Die With Zero is definitely for people who have a decent income, some financial security, and have already looked into saving up. Also for young people planning their long-term future.

It doesn’t apply to:

🤑 Big Spenders – people who are a bit YOLO and spend all their money on fun stuff. If you’re in this category, Bill would say: it’s great that you’re enjoying life. But you need to save up, to avoid a stressful retirement.

❌ People with no disposable income – This book is definitely not aimed at people who are only making enough money to live on. If you’re in this category, then by definition you need to spend your money right now just to survive, with almost nothing left over. Like Bill says: ‘…people in poverty are probably already doing all they can to get the most out of their money and their life.’ In that case, the book I’d recommend is The Millionaire Fast Lane by MJ DeMarco.

☘️ How the Book Changed Me

- I used to think that spending money on experiences and things in my 20’s was a bit frivolous. Shouldn’t I put it all in the S&P 500, to get compounding interest? Die With Zero made me realise that not having those experiences when I’m young is way more wasteful.

- I now think of money as a tool for getting things I actually care about, not as an end in itself.

- I’ve started to notice that being money-focused stops me from asking ‘what experiences do I want to have in my life’?

✍️ My Top 3 Quotes

- “The sad truth is that too many people delay gratification for too long, or indefinitely. They put off what they want to do until it’s too late, saving money for experiences they will never enjoy.”

- “When the end is near, we suddenly start thinking, What the hell am I doing? Why did I wait this long? Until then, most of us go through life as if we had all the time in the world.”

- “We all get one ride on this roller coaster of life. Let’s start thinking about how to make it the most exciting, exhilarating, and satisfying ride it can be.”

📒 Summary + Notes

“If you’ve got any money left in your bank account by the time you die, you’ve done something wrong”.

That’s the core message of this book. And it’s pretty controversial. But I think Bill backs it up.

His first argument is that the money we earn represents life energy.

💡 Money = Life Energy

We all need to make and spend money to survive – buy food, pay rent, cover the bills.

Once we’ve covered basic expenses, we use our leftover time and money to buy life experiences like going travelling, reading books, going to the cinema, etc.

Beyond basic survival, life is about having fulfilling, meaningful experiences. Maslow’s Hierarchy of Needs illustrates the different levels pretty well:

Now, in an ideal world we’d directly trade in our life energy (in the form of work) for fulfilling experiences. But in the real world, money is the middleman. We need to trade in life energy for money, so we can:

a) survive

b) afford fulfilling experiences.

Bill argues that most people focus way too much on saving money. Even as they get older, they carry on trading in their valuable time, all for cash they’ll never spend.

Let’s say you die at the age of 85 with $10k left in the bank. That money represents two things:

- The extra several months you worked to earn that $10k

- All the experiences that you didn’t spend that money on: holidays, amazing meals, or (maybe the most valuable thing) a few extra months of retirement.

Bill would say that all the life energy you traded has basically been wasted. You sacrificed so much of your precious time to get it, and now it’s just gathering dust.

The antidote for most people, says Bill, is to spend more money when you’re young.

📈 1. Why You Should Save Less

There are three main reasons for saving less, especially when we’re young. Increasing Earning Power, Memory Dividends, and Old Age.

Let’s break those down.

💸 Reason 1: Increasing Earning Power

The first reason for investing in experiences early is that our earning power generally increases as we get older. So what seems like a big chunk of money when we’re 20 years old is much less significant when we’re 40 years old with a house, some kids, an established career, and a lot more money coming in.

$20 buys you less and less happiness, because you take the small things for granted (food, cinema tickets, books) and start focusing on big-money things like a new car, or fixing up your house.

So not doing something relatively cheap when you’re 18 years old to save money is like taking $10 from your kid’s pocket money to pay rent. It makes no difference to the adult, but it’ll make the kid miserable 😭

So don’t obsess about saving $10 here and there when you’re young. You’ll get way more enjoyment from spending that money right now than in 30 years’ time.

♻️ Reason 2: Memory Dividends

Unlike material possessions, which seem exciting at the beginning but then often depreciate quickly, experiences actually gain in value over time: They pay what I call a memory dividend.– Bill Perkins

Here’s the idea: every year, good experiences we had in the past give us a return on investment. That’s because all of these experience create memories.

Let’s say you go on an amazing 2-month hike through Italy with your friends when you’re 20 years old. You’ll probably have at least 50 years to enjoy those memories, and talk about the trip whenever you hang out.

Compare that with hustling at work for all of your 20s and 30s to save up money, and then going on a trip to Italy when you’re 40. Sure, you’ll be more financially secure. But you’ll have missed out on almost 20 years of good memories, extra life experiences, and group bonding:

The longer you wait, the less time you give your experiences to earn compounding interest.

👴🏻 Reason 3: Old Age

This graph illustrates how, as we get older, even though our spending power usually increases (and we can afford to do expensive things), our actual ability to do all that stuff steadily decreases. We can’t travel as far, do tough physical activities like skiing, and we have less energy.

So it makes sense to spend a decent chunk of money on cool experiences (long-distance travel, moving countries, rock-climbing) while we’re still fairly young.

🤔 2. Common Objections

Let’s discuss some common objections to the idea of saving less money.

👵 a) What if I run out of money before I die?

This is called longevity risk.

Nobody wants to die early. But no one wants to die after their retirement money runs out either. But here’s the thing: most people who do save actually save way too much, and spend much less during their retirement than they thought.

Bill cites a bunch of figures and studies in his book about ‘knowing your peak’. Essentially, when should you stop saving money and actually retire?

I won’t replicate all of his calculations here. But Bill’s main point is that we fear running out of money a lot more than it’s actually likely to happen. People who save for the future tend to save up too much, and wait until too late in their lives to spend it on fulfilling experiences, if at all.

‘Once you’re in the habit of working for money to live, the thrill of making money exceeds the thrill of actually living.’ – Bill Perkins

⚠️ Big caveat: this all assumes you’re a reasonably high earner with disposable income and savings. If you’re not, please don’t take the book too seriously.

👨👦👦b) What about the kids?

Isn’t dying with zero really selfish? What about leaving money for your kids?

The problem is, if you only give away your money when you die, your kids will be 50-60 when they get their inheritance. And at that age they’ll already have a job, decent earning power, and their own savings – a big windfall won’t be massively helpful to them, relatively speaking.

But if you give them that money when they’re 25-35, that windfall will be ridiculously helpful. With a big chunk of cash at that age, your kids can:

🏡 Put down a deposit on a house

👔 Start their own company

👪 Afford to have their own kids

🪂 Pursue interesting careers instead of working horrible jobs to make rent.

Don’t wait until you die to give money away to your kids. If you’re going to do it, do it when you’re alive, and when they’re younger, when the money will be most effective.

💝 c) What about charity?

The same reasoning applies for charity. Charities need money right now. People are dying in the world right now.

So giving your money away sooner rather than later is a good idea, especially if you can stop certain problems like climate change from getting even worse. Check out the charity research website GiveWell, if you want your money to go as far as possible.

✅ 3. Actionable Advice

So overall, we should be a little less concerned with saving up loads of money, and instead try to gain more experiences. Especially when we’re young. Let’s look at two concrete tips on how to do this.

🪣 Tip 1: Time Bucket Your Life

You need three basic resources for good life experiences: Free Time, Money, and Health. You have different levels of these at different points in your life:

When you’re young you’re pretty broke, but a ‘time millionaire’. In middle-age you’ve got a decent balance of health, wealth, and free time. And when you’re old you usually have enough time and money, but you’re not as healthy as you used to be.

- So, if you really want to cycle across Asia, do it before you’re 50 years old, when you’re still fit enough.

- Want to have kids before you’re 30? Stick it down in the 20-30 category.

- And if there are expensive things you’d like to do someday but aren’t a priority right now, put them down for later, when your earnings will have increased and the cost won’t be such a factor.

Remember, not all experiences can wait. If there’s a band you really want to see live, do it ASAP, while they’re still around.

💪 Tip 2: Be Bold, Not Foolish

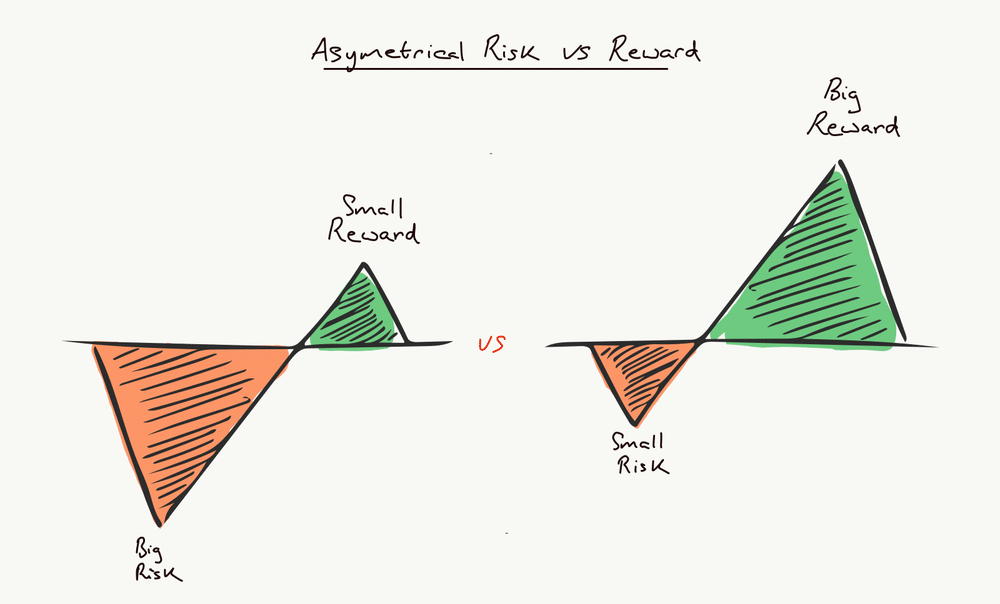

Take your biggest risks when you’re young and don’t have much to lose.

You have more time to build yourself back up if you fail. But a whole lifetime to enjoy the profits if the risk pays off. The risk-reward ratio is asymmetric, with the reward really in your favour.

Let’s say you gamble $1000 on starting a small business when you’re 20, and it fails. You can easily earn that money back in the future. But if the business takes off, it might make you a millionaire. The same goes for moving to a new city or some other big life decisions with potentially big advantages.

Bill points out that the downside of not even taking a chance is emotional: ‘potentially a lifetime of wondering “what if”’.

There’s a great sense of pride at having pursued an important goal wholeheartedly. If you’ve given something your all, you’ll get a lot of positive memories out of the experience no matter what happens. – Bill Perkins

But when you’re older, big financial risks aren’t usually worth taking, as they can leave you without enough money to retire. You’re also likely to have many more responsibilities when you’re older (like a family and kids to take care of).

☝️ 4. Potential Weaknesses

I really like Die with Zero. But I’ve got two caveats to what Bill says.

🏄 1. Money ≠ Life Energy

Bill’s main point at the start of the book is that money in your bank account = life energy. But with passive income for example, a small initial effort snowballs and creates more and more wealth effortlessly. That’s why MJ DeMarco in Millionaire Fast Lane says you should ‘grow money trees’: business systems that survive on their own.

In theory, you can end up a millionaire with loads in your account without having worked a day past your 25th birthday. Like if you write a book that sells insanely well. Then, the money you earn doesn’t represent significant “wasted life energy” in the same way as, say, working 50 years in a job you hate.

🥢 2. Money Gives You Optionality

Liquidity (having easily-accessible cash in the bank or in safe investments) is a big asset in itself, because you can act quickly and decisively if a cool opportunity comes up, or if there’s a sudden emergency.

Basically, savings keep your options open in case you:

🇲🇽 Find your dream retirement home in Mexico

💼 Want to invest in a friend’s new company

🏥 Need to pay for medical bills

Having money in the bank lets you immediately pull the trigger. So, someone might rationally and happily keep a lot of money in their bank account until they die, just to keep those options open.

🪢 5. Conclusion

All in all, I massively recommend Die With Zero. Here’s the key message: don’t save so much that you forget to enjoy your life.

Check out my full video summary here:

And if you’d like to read more of my Book Summaries, you might find these interesting:

- Atomic Habits – one of my all-time favourite books about productivity and building habits.

- Your Money or Your Life – Another book that changed my perspective on personal finance.